Are License Plates Fees Deductible . annual car registration fees may be deductible on federal income taxes, but only the portion of the fee that is charged based on the vehicle's value. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. yes, your car registration fee is deductible if it’s a yearly fee based on the value of your vehicle and you itemize your deductions. to calculate your vehicle registration fee deduction, you will first need to determine the total amount of your registration fees. learn how to deduct annual licence fees and some business taxes you incur to run your business on line 8760 of your tax return. you can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. All vehicle expenses are reported in the business vehicle use section of the.

from gabrielatkins.z19.web.core.windows.net

learn how to deduct annual licence fees and some business taxes you incur to run your business on line 8760 of your tax return. annual car registration fees may be deductible on federal income taxes, but only the portion of the fee that is charged based on the vehicle's value. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. All vehicle expenses are reported in the business vehicle use section of the. you can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. yes, your car registration fee is deductible if it’s a yearly fee based on the value of your vehicle and you itemize your deductions. to calculate your vehicle registration fee deduction, you will first need to determine the total amount of your registration fees.

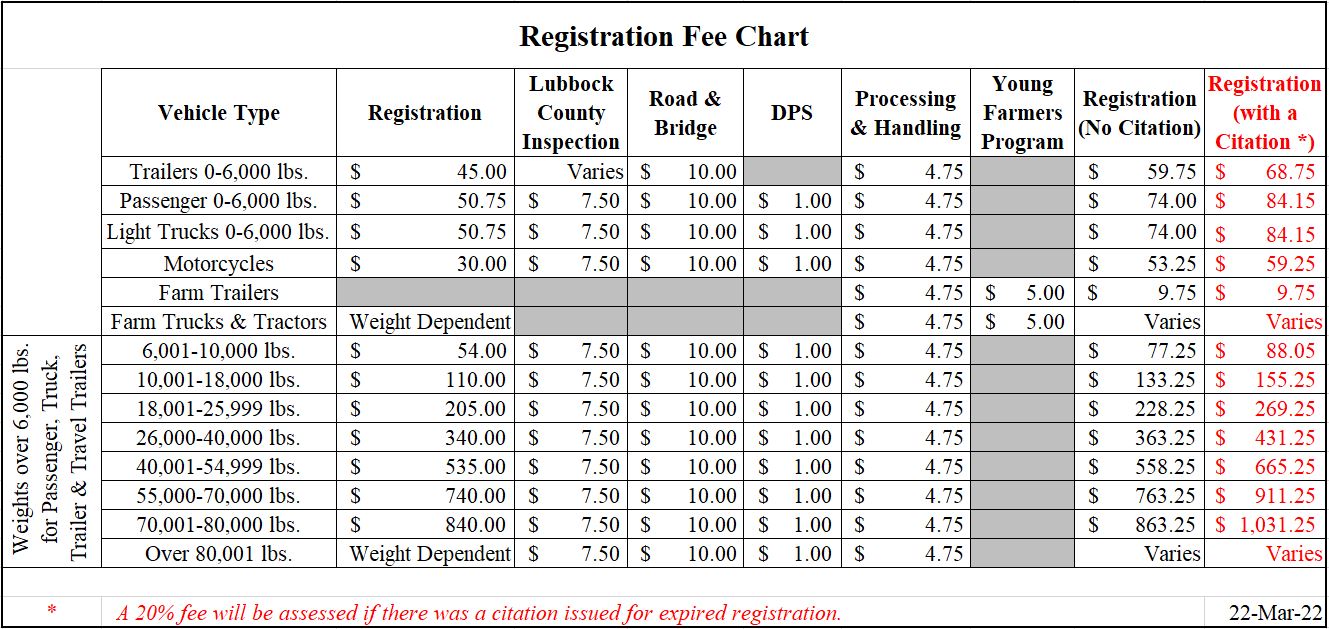

Pa Vehicle Registration Fee Chart

Are License Plates Fees Deductible 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. learn how to deduct annual licence fees and some business taxes you incur to run your business on line 8760 of your tax return. All vehicle expenses are reported in the business vehicle use section of the. you can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. to calculate your vehicle registration fee deduction, you will first need to determine the total amount of your registration fees. annual car registration fees may be deductible on federal income taxes, but only the portion of the fee that is charged based on the vehicle's value. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. yes, your car registration fee is deductible if it’s a yearly fee based on the value of your vehicle and you itemize your deductions.

From www.theregister.com

California legalizes digital license plates for all vehicles • The Register Are License Plates Fees Deductible All vehicle expenses are reported in the business vehicle use section of the. to calculate your vehicle registration fee deduction, you will first need to determine the total amount of your registration fees. learn how to deduct annual licence fees and some business taxes you incur to run your business on line 8760 of your tax return. . Are License Plates Fees Deductible.

From www.lookupaplate.com

U.S. License Plate Sizes and Dimensions Guide LookupAPlate Are License Plates Fees Deductible to calculate your vehicle registration fee deduction, you will first need to determine the total amount of your registration fees. you can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. yes, your car registration fee is deductible if it’s a yearly fee based on the value of your vehicle. Are License Plates Fees Deductible.

From www.illinoispolicy.org

Illinois license plate sticker among most expensive in the nation Are License Plates Fees Deductible you can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. learn how to deduct annual licence fees and some business taxes you incur to run your business on line 8760 of your tax return. to calculate your vehicle registration fee deduction, you will first need to determine the total. Are License Plates Fees Deductible.

From www.carscoops.com

Pricey But Nifty Digital License Plates Coming To Michigan In 2021 Are License Plates Fees Deductible to calculate your vehicle registration fee deduction, you will first need to determine the total amount of your registration fees. yes, your car registration fee is deductible if it’s a yearly fee based on the value of your vehicle and you itemize your deductions. annual car registration fees may be deductible on federal income taxes, but only. Are License Plates Fees Deductible.

From exohieojq.blob.core.windows.net

How To Take Tags Off License Plate at Joseph Foster blog Are License Plates Fees Deductible yes, your car registration fee is deductible if it’s a yearly fee based on the value of your vehicle and you itemize your deductions. annual car registration fees may be deductible on federal income taxes, but only the portion of the fee that is charged based on the vehicle's value. All vehicle expenses are reported in the business. Are License Plates Fees Deductible.

From pocketsense.com

Can LicenseTab Tax Be Deductible? Pocket Sense Are License Plates Fees Deductible 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. you can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. All vehicle expenses are reported in the business vehicle use section of the. to calculate your vehicle. Are License Plates Fees Deductible.

From exonxqbxo.blob.core.windows.net

Are Professional License Fees Tax Deductible at Jo Anderson blog Are License Plates Fees Deductible annual car registration fees may be deductible on federal income taxes, but only the portion of the fee that is charged based on the vehicle's value. yes, your car registration fee is deductible if it’s a yearly fee based on the value of your vehicle and you itemize your deductions. to calculate your vehicle registration fee deduction,. Are License Plates Fees Deductible.

From www.factorywarrantylist.com

DMV Fees by State USA Manual Car Registration Calculator Are License Plates Fees Deductible you can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. All vehicle expenses are reported in the business vehicle use section of the. yes, your car registration. Are License Plates Fees Deductible.

From www.youtube.com

How to find Tax Deductible Vehicle License Fee (VLF) _ stepbystep Are License Plates Fees Deductible All vehicle expenses are reported in the business vehicle use section of the. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. yes, your car registration fee is deductible if it’s a yearly fee based on the value of your vehicle and you itemize your. Are License Plates Fees Deductible.

From cathaqelisabeth.pages.dev

Driver License Renewal Fee 2024 Dita Sharline Are License Plates Fees Deductible 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. to calculate your vehicle registration fee deduction, you will first need to determine the total amount of your registration fees. you can deduct motor vehicle expenses only when they are reasonable and you have receipts. Are License Plates Fees Deductible.

From money.stackexchange.com

united states Is supporting a charity through specialty license Are License Plates Fees Deductible All vehicle expenses are reported in the business vehicle use section of the. annual car registration fees may be deductible on federal income taxes, but only the portion of the fee that is charged based on the vehicle's value. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace. Are License Plates Fees Deductible.

From www.reddit.com

Is 754 a lot for registration and license fee? r/bayarea Are License Plates Fees Deductible annual car registration fees may be deductible on federal income taxes, but only the portion of the fee that is charged based on the vehicle's value. learn how to deduct annual licence fees and some business taxes you incur to run your business on line 8760 of your tax return. to calculate your vehicle registration fee deduction,. Are License Plates Fees Deductible.

From gabrielatkins.z19.web.core.windows.net

Pa Vehicle Registration Fee Chart Are License Plates Fees Deductible you can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. to calculate your vehicle registration fee deduction, you will first need to determine the total amount of your registration fees. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace. Are License Plates Fees Deductible.

From azdot.gov

The 10 most popular speciality license plates in Arizona for 2022 Are License Plates Fees Deductible learn how to deduct annual licence fees and some business taxes you incur to run your business on line 8760 of your tax return. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. yes, your car registration fee is deductible if it’s a yearly. Are License Plates Fees Deductible.

From kentuckylicenseplate.com

Kentucky License Plate Fees Kentucky License Plate Are License Plates Fees Deductible yes, your car registration fee is deductible if it’s a yearly fee based on the value of your vehicle and you itemize your deductions. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. annual car registration fees may be deductible on federal income taxes,. Are License Plates Fees Deductible.

From h-o-m-e.org

A Guide to Illinois License Plate Renewal Fees Are License Plates Fees Deductible yes, your car registration fee is deductible if it’s a yearly fee based on the value of your vehicle and you itemize your deductions. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. learn how to deduct annual licence fees and some business taxes. Are License Plates Fees Deductible.

From flyfin.tax

Taxes and Licenses As A 1099 Tax Deduction Are License Plates Fees Deductible All vehicle expenses are reported in the business vehicle use section of the. you can deduct motor vehicle expenses only when they are reasonable and you have receipts to support them. 20 rows find out how much it costs to renew your licence plate, get a new one, or replace a damaged one. yes, your car registration. Are License Plates Fees Deductible.

From katu.com

Gallery Special Oregon license plates KATU Are License Plates Fees Deductible learn how to deduct annual licence fees and some business taxes you incur to run your business on line 8760 of your tax return. to calculate your vehicle registration fee deduction, you will first need to determine the total amount of your registration fees. All vehicle expenses are reported in the business vehicle use section of the. . Are License Plates Fees Deductible.